In the ever-evolving landscape of finance, FinTech emerges as a game-changer for Islamic finance, presenting a pivotal opportunity to instigate essential reforms. Aligning operations with real objectives is paramount, and neglecting this transformative moment could prove detrimental to the very core of Islamic finance. This article delves into the potential synergy between FinTech and Islamic finance, emphasizing the need for industry leaders to recognize and harness this unprecedented opportunity.

The regulatory environment of FinTech, characterized by its light-touch approach, provides a conducive space for Islamic financial institutions to integrate Sharia-authentic practices. In contrast to the constraints of tightly regulated banking sectors, FinTech offers a platform to explore and incorporate aspects that align with Sharia principles. However, the key lies in utilizing FinTech not just for Sharia compliance but, more importantly, for the pursuit of Sharia authenticity.

Sharia authenticity, as distinct from mere compliance, mandates that Islamic financial transactions transcend the realm of monetary exchanges. It calls for transactions to be genuinely real, emphasizing a deeper commitment to the principles of Islamic finance. Furthermore, Sharia authenticity advocates for realism in financial transactions, challenging institutions to move beyond superficial adherence and instead focus on embodying the true spirit of Islamic finance.

The urgency for embracing FinTech in the realm of Islamic finance is underscored by the industry's need to stay relevant and effective. This technological wave presents an unprecedented opportunity to enhance the authenticity of Sharia-compliant practices, steering them towards tangible and meaningful outcomes. Leaders within the Islamic finance sector must not only recognize but actively seize this moment to propel the industry forward.

As the financial landscape continues to evolve, the fusion of FinTech and Islamic finance becomes not just a strategic choice but a necessity. It is a call to action for industry leaders to embrace innovation and leverage technology to usher in a new era of authenticity, aligning practices with the genuine objectives of Islamic finance. The journey toward Sharia authenticity in financial transactions demands commitment, foresight, and a proactive approach from all stakeholders in the Islamic finance ecosystem.

By navigating the FinTech era with foresight and innovation, Islamic finance can redefine its role in the global financial landscape. The call to action is clear: industry leaders must leverage technology not only to meet compliance standards but to embody the true spirit of Islamic finance. In doing so, they contribute to a narrative of progress, authenticity, and resilience that will define the future of Islamic finance in the FinTech era. As the industry adapts, innovates, and forges ahead, the promise of a more authentic and impactful Islamic finance ecosystem beckons on the horizon.

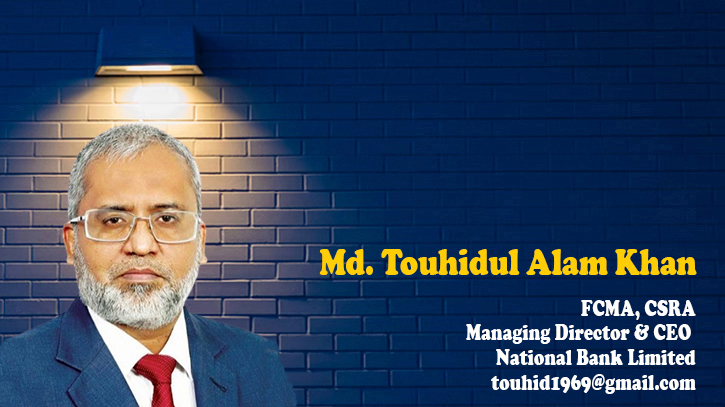

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.