Islamic finance symbolizes a unique and multifaceted industry that transcends traditional banking practices, challenging the widespread perception that it is synonymous solely with Islamic banking. In reality, Islamic banks, while accounting for a substantial portion—71.7%—of the global financial landscape, represent only one facet of a broader spectrum of financial services guided by Islamic principles. Key components such as Sukuk (Islamic bonds), Islamic funds, and Takaful (Islamic insurance) collectively contribute to the vibrant financial ecosystem established within the framework of Islamic finance. Insights into these sectors are further illuminated by the Islamic Financial Stability Report published by the Islamic Financial Services Board (IFSB) in 2019.

When examining the operational strategies of Islamic banks, one cannot overlook their innovative approaches to deposit mobilization. The Mudarabah model, which embodies a partnership-based investment deposit strategy, is commonly employed alongside Qard, which caters to non-remunerative deposits such as current accounts. The Mudarabah structure is particularly noteworthy as it establishes a profit-sharing arrangement, based on pre-agreed ratios between the investors (Rabbul Mal) and the bank (Mudarib). This model ensures that investors assume the financial risks and losses, while the bank absorbs operational losses. Such a risk-sharing mechanism fundamentally distinguishes Islamic finance from conventional banking, where the financial burden can often be disproportionately shouldered by one party alone.

The asset side of Islamic finance employs a diverse array of financial modes that combine ethical principles with risk-sharing and profit-sharing. Among these modes, trade-based tools, including Murabaha, Musawamah, Istisna, and Salam, feature prominently, in addition to lease-based strategies like Ijarah. Partnership-based models such as Musharakah and Mudarabah further enhance the array of options available to clients. Each of these financing structures not only promotes ethical conduct in financial dealings but also aligns with the fundamental values of profit-sharing and equity, thus reinforcing the integrity of the financial system.

In practice, the dynamic relationship between clients and Islamic banks unfolds through a model where clients frequently assume the role of agents for the banks in various transactions. This collaborative engagement is particularly evident in Murabaha transactions, where clients purchase assets on behalf of the bank prior to the formal execution of the trade contract. Likewise, in Ijarah and Diminishing Musharakah frameworks, clients actively participate in asset acquisitions, underscoring the interactive relationship that defines Islamic finance. This approach not only fosters a sense of partnership but also serves to enhance transparency and trust in financial transactions.

Moreover, the operational principles embedded within Islamic finance are designed to promote social justice, prevent exploitation, and uphold ethical standards. By integrating risk-sharing into the core of financial interactions, Islamic finance advocates for equitable sharing of wealth, minimizing the disparities commonly associated with conventional financial systems. The intricate construction of these financing modes reflects a commitment to societal welfare and the avoidance of harm, aligning financial ambitions with ethical considerations.

Islamic finance also extends its influence into sectors that traditionally fall outside conventional banking's purview. For instance, Sukuk instruments have gained increasing popularity, allowing governments and organizations to raise capital while adhering to Islamic jurisprudence. Takaful, or Islamic insurance, serves as another critical sector, providing coverage that upholds the principles of cooperation and mutual assistance, markedly differing from conventional insurance models.

In conclusion, Islamic finance represents a sophisticated and intricate financial ecosystem that encompasses much more than traditional banking services. By delving into the various sectors and financing modes rooted in Islamic principles, individuals and institutions can cultivate a deeper appreciation for the authenticity, operational excellence, and ethical foundations of Islamic finance. It is crucial to overcome stereotypes and misconceptions associated with Islamic banking to acknowledge the extensive depth and complexity inherent in Islamic finance as a comprehensive system. This nuanced understanding will undoubtedly pave the way for a more informed perspective on the relevance and significance of Islamic finance in today’s increasingly interconnected and diverse financial landscape. As the world continues to seek more ethical and equitable financial solutions, the role of Islamic finance is set to become even more pronounced, offering viable and principled alternatives for both investors and consumers alike.

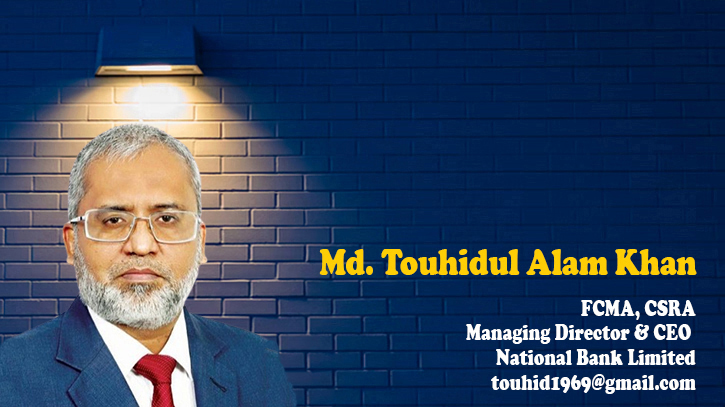

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/EHM