Islamic financial institutions are increasingly recognized for their significant involvement in the supply chain of financed assets, marking a departure from the traditional banking model. While conventional banks primarily focus on providing monetary loans without engaging directly with the assets, Islamic banks operate under a different paradigm. This is rooted in the principles of Islamic finance, which mandate that banks must hold ownership and possession of the assets involved while also assuming the associated risks throughout trade and lease contracts. This foundational principle compels Islamic banks to engage more deeply within the supply chain than their conventional counterparts.

In practices such as Murabaha, Ijarah, and Diminishing Musharakah, Islamic banks must ensure that they possess and own the asset before offering it for sale or lease to clients. This requirement introduces a layer of complexity, as Islamic banks need to manage the risks associated with asset ownership for extended durations. To further mitigate these risks, they employ strategies such as locking in the credit price during deferred payment sales and establishing rental schedules for lease financing, often secured by unilateral commitments from the client. While this approach enhances the security of the transaction for financiers, it also raises questions about the equivalency of Islamic financing to traditional banking, as the end outcomes and economic effects can appear very similar.

Criticism has emerged regarding the potential indistinguishability of Islamic banking from conventional banking practices, particularly in terms of risk management and cash flow dynamics. In response, prominent scholars within the field have pushed for the development of equity-based financial products that bolster risk-sharing and provide clearer distinctions in cash flow implications. However, the current landscape of Islamic finance reveals a limited range of product offerings, making it challenging to cater to the diverse needs of businesses, particularly those grappling with financial distress who may not be in the market for asset acquisition.

The allocation of financing by Islamic banks compared to conventional banks often reveals disparities, especially evident in various sectors such as agriculture and small to medium enterprises (SMEs). In several markets, Islamic banks exhibit a tendency to concentrate on larger corporate clients, thereby potentially neglecting smaller firms and rural agriculture sectors that require financial inclusivity. This imbalance signifies the challenges faced by Islamic banks in effectively addressing issues related to market concentration and potential supply chain bottlenecks.

Moreover, the reliance on debt-based financing mechanisms within Islamic banking results in higher average financing costs, surpassing those of conventional banks. This trend is notably observable in sectors facing liquidity challenges, such as the energy sector, where phenomena like circular debt persist. The issuance of Sukuk and other debt-based instruments have not demonstrated improved liquidity management compared to conventional financing methods, underscoring the need for more innovative approaches within the Islamic finance framework.

This exploration into the role of Islamic banks in the supply chain offers valuable insight into both current practices and future potential. By introducing novel financial structures, particularly those leveraging social finance concepts such as Waqf alongside equity-based financing, Islamic banks can enhance their engagement with the supply chain while promoting greater financial inclusivity. Future research avenues may benefit from examining the capacity of Islamic banking to engage in value-based intermediation and its role within global value chains, all of which are crucial for fostering sustainable economic development and ensuring robust financial stability in the long run.

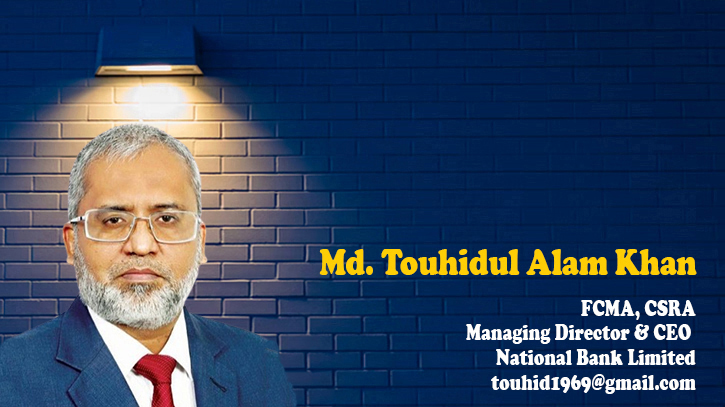

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/EHM