Photo : Messenger

The ruling party, Awami League (AL), has successfully concluded the 12th national parliamentary elections, overcoming all obstacles and securing an absolute majority in the process. International recognition has also begun to pour in. The new cabinet is set to be formed tomorrow following the oath-taking ceremony of parliament members (MPs) today.

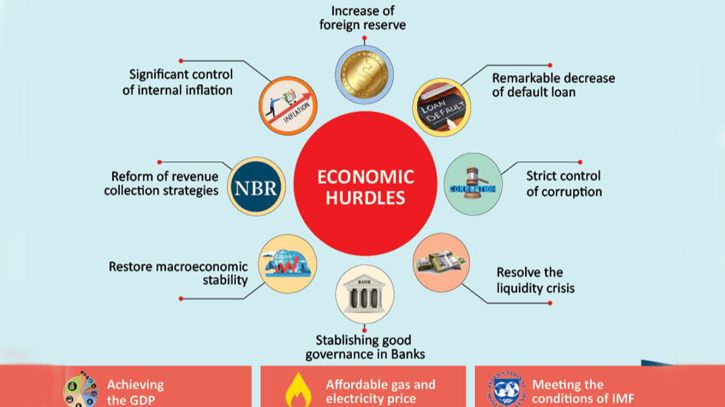

In this scenario, the AL, poised to form the government for the fourth consecutive time, has largely surmounted the political crisis. However, a significant challenge now emerges for the party in addressing the economic crisis. Analysts point out that the new government faces formidable tasks such as increasing reserves, controlling inflation, reducing defaulted loans, and bringing corrupt individuals under the purview of the law.

Moreover, challenges include resolving the liquidity crisis, establishing good governance in banks, restoring macroeconomic stability, formulating medium and long-term revenue strategies, adhering to IMF conditions, managing foreign debt repayment, and controlling energy and power prices.

Political analyst Professor Bashir Ahmed told The Daily Messenger, “Apprehensions about the elections at home and abroad appear to have subsided. Although the United States and the United Kingdom have expressed negative views on the elections, the primary challenge for the new government will be overcoming the economic crisis. In particular, increasing reserves and controlling inflation will prove to be quite challenging.”

Over the past year, the government faced pressure from domestic and foreign quarters due to a significant drop in the country's reserves. Despite remittances and export income, the reserve deficit persisted, leading the government to borrow from institutions such as the World Bank, JICA, and the IMF. The IMF imposed several conditions, which the government has yet to fulfill.

Although the IMF has relaxed some conditions and released two installments of the loan, the international credit organisation maintains that various reforms are necessary for the country's economy. According to the new IMF conditions, real reserves were to be held at $17.78 billion in December, $19.26 billion in March, and $20.10 billion in June.

Meanwhile, foreign exchange reserves fell to $25.75 billion on Tuesday after the Asian Clearing Union (ACU) paid $1.27 billion in import bills for November and December. According to the BPM-6 manual, the reserves have now decreased to $20.48 billion.

In this situation, stakeholders in the financial sector express skepticism about the feasibility of meeting the conditions set by the IMF. Even the finance minister himself is not optimistic. Finance Minister AHM Mustafa Kamal remarked about the reserves at the secretariat on Tuesday, “Meeting the foreign exchange reserve target set by the IMF is never possible. However, our reserves are in good condition compared to other countries.”

“The prime minister highlighted that the main challenge ahead is the economy,” responded the finance minister when questioned by reporters. “What the prime minister said is accurate.

We share the same perspective. If the economy weakens, how can the government sustain itself, and how will the country progress? I maintain that we are in a favourable position.”

Khondaker Golam Moazzem, the research director of the Centre for Policy Dialogue (CPD), told The Daily Messenger, “The new government must address various economic crises. On one hand, there is the pressure of preserving reserves, and on the other, it must handle the challenges of controlling high inflation and reducing defaulted loans.”

He also added, “Furthermore, the government's repayment of loans obtained for various mega projects from abroad, including the associated interest, commences this year. Consequently, the government will also need to address the looming dollar crisis.”

Dr Iftekharuzzaman, Executive Director of Transparency International, Bangladesh (TIB), told The Daily Messenger, “The country's major problem is corruption, often perpetrated by those in power. Simultaneously, corruption has wreaked havoc on the country's banking system, making it challenging to salvage banks burdened with defaulted loans.”

“While international norms are sometimes blamed for inflation, this is not universally true. The surge in commodity prices is often driven by domestic profit-seekers and corrupt individuals, many of whom are MPs or ministers close to the government. Consequently, it will be exceedingly challenging for the government to control them,” he added.

Messenger/Disha